stop on quote vs stop limit on quote etrade

A stop-limit-on-quote order is a type of order that combines the features of a stop-on-quote order with those of a limit order. Stop orders may be triggered by a short-lived dramatic price change.

Stop On Quote Vs Stop Limit On Quote Orders Money Rook

What the stop-limit-on-quote order does is enable an investor to execute a trade at a specified price or better after the stock price has reached the investors desired stop price.

. Bad thing about SLOQ is if. When it comes to managing risk stop orders and stop-limit orders are both useful tools but they arent the same. The investor would place such a limit order at a time when the stock is trading above 50.

The stock will be sold at your limit price or better but if a buyer isnt available at the limit price the order wont be executed. Lets consider a trader who bought FB for 155 and it is now trading at 185. In the ABC example above a stop-limit order would look like this.

Join Kevin Horner to learn how each works. Etrade also lets you specify your stop value as a dollar amount below the current price instead of a percentage. The stop price is a price that is above the market price of the stock whereas the limit price is the highest price that a trader is willing to pay per share.

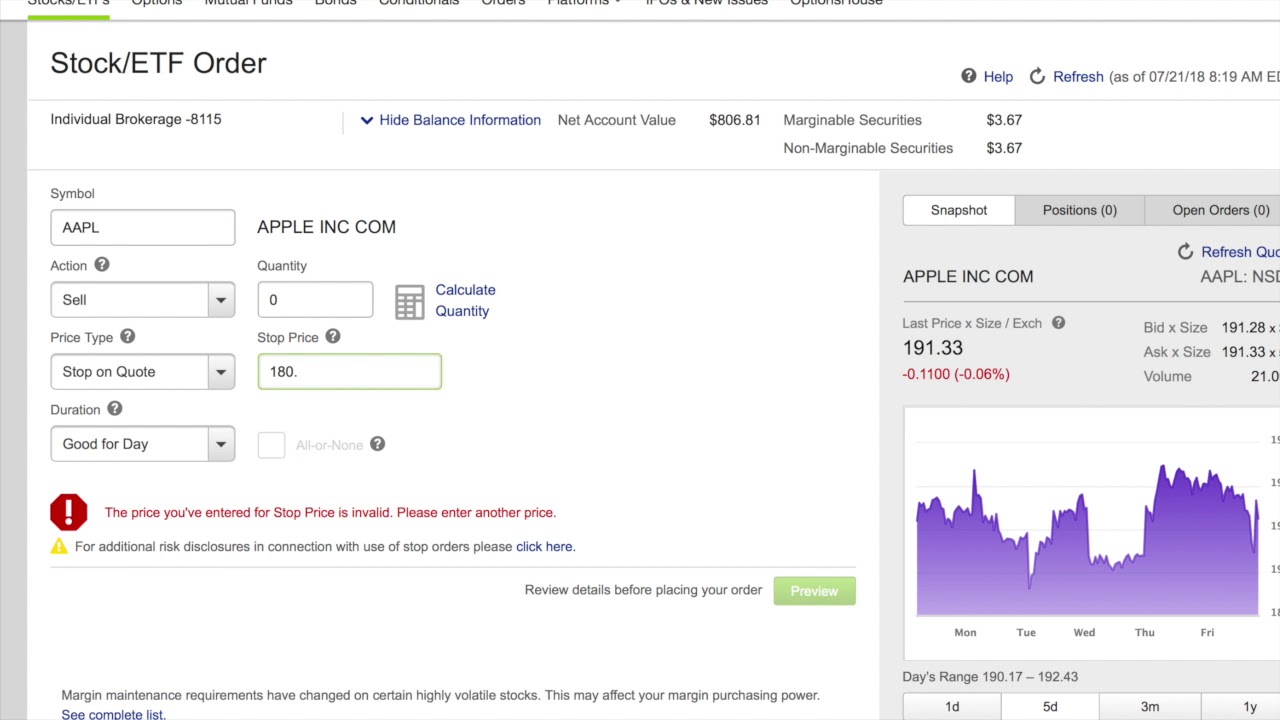

With a stop limit order traders are guaranteed that if they receive an execution it will. A buy stop quote limit order is placed at a stop price above the current market price and will trigger if the national best offer quote is at or higher than the specified stop price. Select Stop-Limit under the drop-down menu for the Price Type Then enter the Limit Price and Stop Price you wish to pay when executing the trade.

You pick a stop price of 8 and a limit. For example if John intends to buy ABC Limited stocks that are valued at 50 and are expected to go. Such an order would become an active limit order if market prices reach 300 however the order can only be executed at a price of 250 or better.

For example for an investor looking to buy a stock a limit order at 50 means Buy this stock as soon as the price reaches 50 or lower. Account holders will set two prices with a stop limit order. When you enter a stop limit on quote order you are placing an order that will turn into a limit order when the stock reaches the stop price.

A buy stop order executes at a stop price that is above the current market price. The stop price and the limit price. A limit order will then be working at or better than the limit price you entered.

So the stop limit protects against fast price declines. I literally just placed a Stop Limit on Quote with a Stop Trigger of 26099 with a Limit Price of 26099 which your post says isnt working. Limit is an important distinction that can significantly change the outcome of your order.

What the stop-limit-on-quote order does is enable an investor to execute a trade at a specified price or better after the stock price has reached the investors desired stop price. In contrast a sell stop order executes at a stop price below the current market price. How Limit and Stop Orders Work.

Thus if you are long in a trade and your stop level is reached the trade will only be exited at the limit price or higher. If the stock suddenly crashes to 7 making your sell order at 7 the broker wouldnt execute the stop loss because it is below your limit of 850. When the stop price is triggered the limit order is sent to the exchange.

Explain further what youre trying to do. A limit order is an instruction to the broker to trade a certain number shares at a specific price or better. The Limit Price is the limit of what you are willing to buy or sell the shares for when executing the trade.

Stop prices are not guaranteed execution prices. Stop on quote vs stop limit on quote etrade. It is possible placing a limit price on a stop order may.

With a stop-on-quote order a trade will only be initiated once the price reaches a specified level or trigger called a stop price. This effectively guarantees me a minimum gain of 425. The stop-loss order allows me to limit my losses while also allowing me to participate in uptrends as long as they continue without correcting to my stop level.

Stop limit orders are slightly more complicated. Stop Loss on Quote is sell the stock to the BID price when the stock price reaches the set price. In a stop loss situation your broker wouldve just sold your stock as soon as it crossed below 9 in this example you wouldve sold at 7.

If you use a stop-limit order once the stop level is reached a limit order will be sent out. A stop-limit-on-quote order is an order that an investor. Stop Loss Limit Etrade changed the stop loss function some time ago.

Trailing Stop-on-Quote Orders A trailing stop-on-quote order is a trailing sell stop that fluctuates by a given percent or point dollar amount allowing for the potential to lock in more profit on the upside while still protecting yourself from. To protect a portion of their gains 15 the trader places a sell order to stop at 170. Whenever the bid price sell orders or ask price buy orders reaches or surpasses the stop price the stop-on-quote order becomes a market order.

For example a sell stop limit order with a stop price of 300 may have a limit price of 250. The Stop Price is the price at which the trade becomes a market order. When you enter a stop limit on quote order you are placing an order that will turn into a limit order when the stock reaches the stop price.

The stop price and the limit price for a stop-limit order do not have to be the same price. A limit order is an order that will only be filled at the limit price or better. For example if you place a stop limit on quote sell order with the stop price at 1009 and the limit price set at 1000 then your shares would sell at 1009 or above but not below the stop limit price of 1000.

Sell stop orders may exacerbate price declines during times of extreme volatility. So provide a screenshot or give steps to reproduce or something.

E Trade Limit And Stop Loss Orders On Stocks 2022

Protecting Yourself With Stops Youtube

E Trade Core Portfolios Review Perfect For The Casual Investor

Potentially Protect A Stock Position Against A Market Drop Learn More

Download Etrade Images For Free

What Are Price Types And How To Execute Them With Etrade 3min Youtube

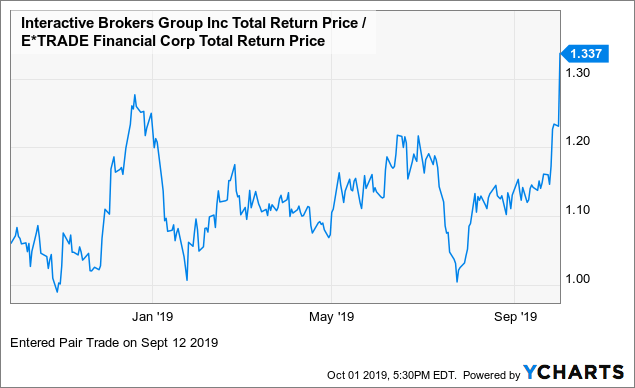

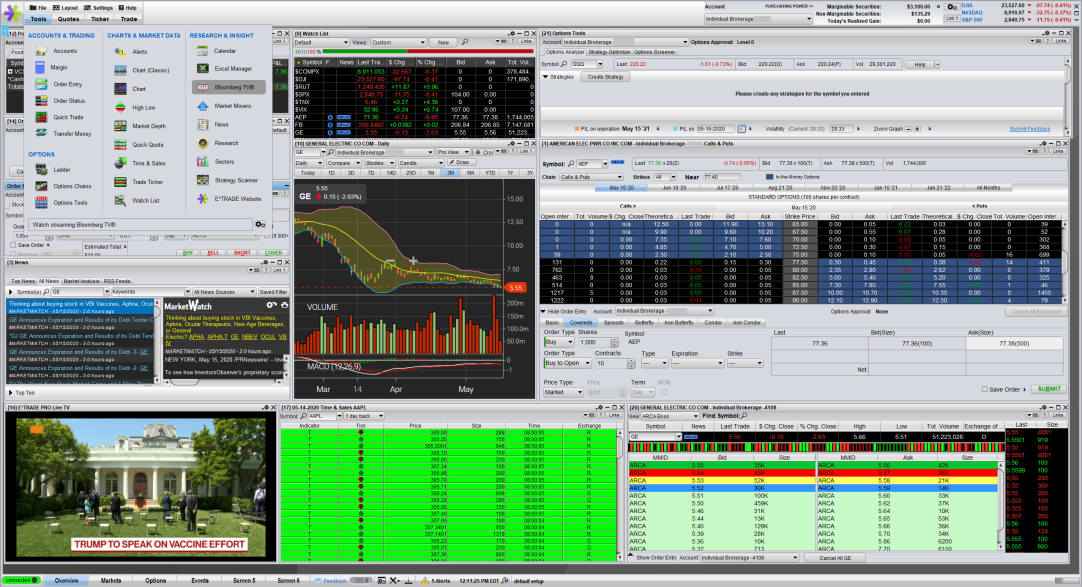

E Trade 2020 Review Exposing The True Drawbacks For A Pro Trader

E Trade 2020 Review Exposing The True Drawbacks For A Pro Trader

E Trade 2020 Review Exposing The True Drawbacks For A Pro Trader

What Is A Stop Loss W Etrade Prince Dykes 4min Youtube

Potentially Protect A Stock Position Against A Market Drop Learn More

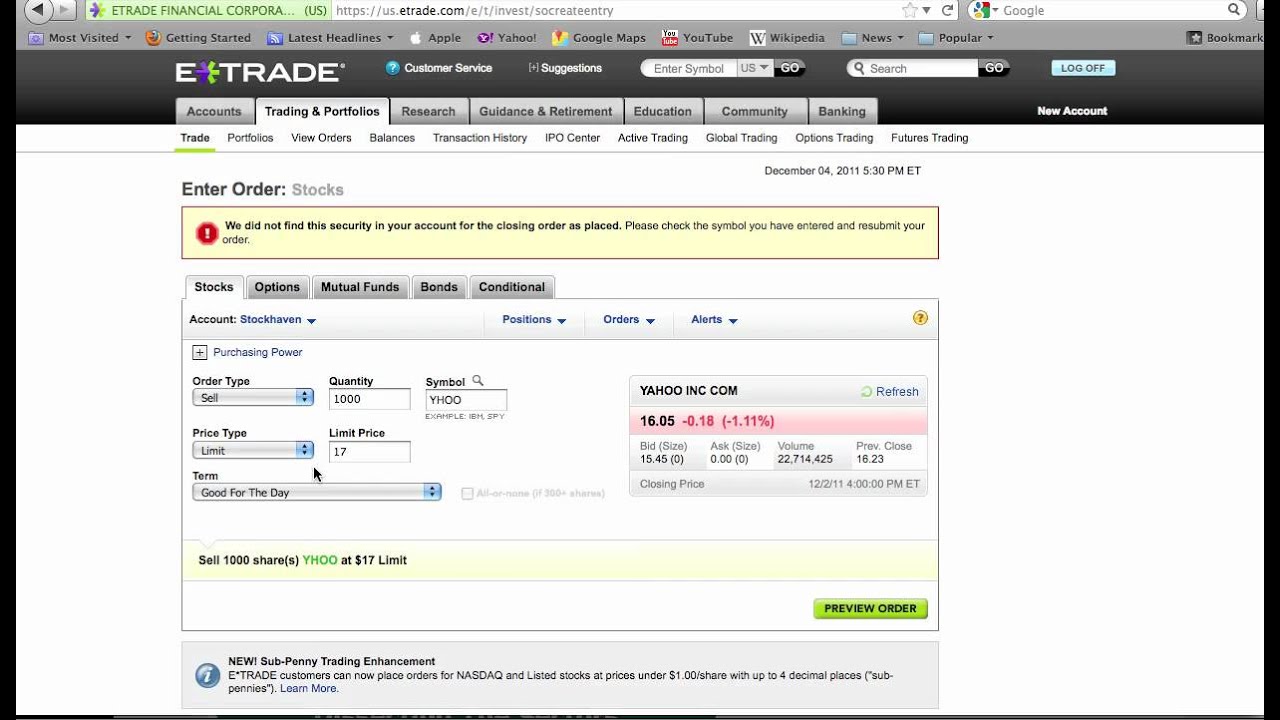

How To Set A Limit Order On Coinbase Stockstotrade And Etrade Rockinpress

Limit Sell Order Etrade Swing Trade Options Newsletter

How To Use A Stop Loss Order When Trading Etrade Pro Youtube